Back to Insights

Back to Insights

White Paper: What Will Differentiate Private Credit Managers in the Next Downturn?

Dec 14, 2022What Will Differentiate Private Credit Managers in the Next Downturn?

Private credit has had a great run over the past decade. Direct lenders supplanted banks as the most important credit providers to middle market businesses while delivering strong performance when the world was starved for yield. It’s helpful to remember this track record was built during a period marked by a “benign” credit environment and a strong economy. Well, things might be changing. Interest rates are rising, the economy is softening, and investors are beginning to ask the question whether private credit can continue to deliver on its promise of capital preservation and stable income.

Investors might look to the trend in default rates for an answer. Rising default rates are a leading indicator of trouble ahead, especially for direct lenders. Unlike lenders in larger, more liquid markets, direct enders can’t trade in and out of positions pre or post default to preserve or create value. They operate in an illiquid market where they make a loan and are repaid through principal payments or refinancing. When a borrower defaults, direct lenders need to work it out, relying on different skills sets than participants in more liquid markets: direct 1:1 negotiation with borrowers, operational and financial restructuring, and, in rare situations, “taking the keys” and managing the business. direct lenders with the right skillsets can drive higher recovery rates and preserve returns in the face of higher defaults.

Over time, recovery rates, not default rates, could have the largest impact on a private credit manager’s ability to deliver their promised income and stability. While rising default rates might be the best leading indicator of mounting credit problems, managers that are able to drive higher recovery rates will end up differentiating themselves in difficult times.

Default Rates vs. Recovery Rates

Investors generally look to a default rate as a proxy for performance because they readily understand this measure – a borrower has stopped paying – and it is the most touted metric for good or bad performance. But it is also important to remember that while a default rate gauges underwriting effectiveness, it is not necessarily the only, nor the best, indicator of long-term performance, especially in times of credit stress. In difficult credit markets, the Recovery Rate – which measures how much of the initial loan a manager recovers over time – illustrates a private credit manager’s ability to preserve value based on decisions and actions taken after making the loan.

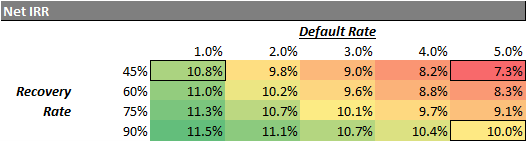

To help make this point, let’s look at a hypothetical private credit portfolio and how it might perform based on different levels of default and recovery rates. For the portfolio, we can model a typical pool of direct loans in the current market: a $1.2 billion portfolio made up of 1st Lien, senior secured loans priced at SOFR +6.0 percent (~10.4 percent as of November 2022) with 2 percent upfront fees and a three-year average duration. The portfolio will be levered 1:1 (so, $600 million of equity capital). The following table shows the portfolio’s performance under various default and recovery rate scenarios.

In a low default rate environment, it’s not surprising that a portfolio can do fine with relatively low recovery rates. With fewer deals in trouble, a manager’s ability to drive recovery in these deals becomes less impactful. When default rates increase and managers are dealing with more troubled transactions, their ability to manage those situations and drive strong recoveries will become increasingly important. For example, with a relatively low 1 percent default rate, even a poor recovery rate of 45 percent can still return close to 11 percent. Move that default rate to 5 percent with the same recovery rate, and the performance drops over 30 percent to a 7.3% internal rate of return, or IRR. With that same 5 percent default rate, if the manager can achieve a 90 percent recovery, the IRR remains relatively stable at 10 percent.

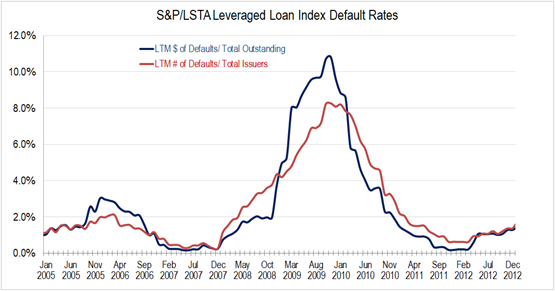

A quick look back at default rates during the last material market downturn – the 2008 financial crisis – highlights what we could experience in the next major downturn. Notably, loan defaults peaked in 2009 more than 10% and remained at or above 4% more than 18 months.

Managers Will Differentiate Themselves by Maximizing Recovery Rates

So, what can private credit managers do to outperform their peers by driving stronger recovery rates and preserving returns? It boils down to two principles: 1) Building the business around key skill sets grounded in sound underwriting and structuring and 2) Practicing active, informed portfolio management.

Core elements of Success: To optimize the first principle, direct lenders must build their business with solid foundations rooted in the following fundamental deal, structural and organizational elements:

- Staffing & Experience: Managers need to build an investment team around experienced leadership that has managed illiquid positions through economic cycles. They will have a long checklist of “lessons learned” that informs decisions and helps to avoid deals that are more likely to experience credit stress. In addition to direct lending / credit investing experience, managers should employ team members with private equity, restructuring, and operational backgrounds in the event a more hands-on approach is required. Also, having a “strong bench” of proven, reliable restructuring experts that a manager has worked with over time is critical.

- Focus on Quality Origination: It is important to have a robust, direct deal “origination engine.” A manager with strong access to deal flow can be more selective. If a manager does not have strong deal flow, it is harder to be selective and they end up chasing marginal transactions. Additionally, focusing on deal flow from experienced private equity investors with an active fund, meaningful initial investment, and sufficient additional capital to support an underperforming company has often been the playbook for success.

- Initial Capital Structure Ensure the business is appropriately levered with a strong equity base. The amount of leverage a business can support is dictated by several factors: the nature and stability of its revenue streams, gross and net margins, free cash flow profile, and exposure to macroeconomic cycles, just to name a few. One business can be over-levered at 2x EBITDA, and another can be conservatively levered at 4x EBITDA.

- Terms: Deal terms and documentation are the foundation a lender relies on when a borrower begins to underperform. Actionable financial covenants, lien protections, monthly financial reporting, restrictions on a borrower’s use of proceeds and additional leverage, are a few of the key terms enabling lenders to have a “seat at the table” when a business underperforms and a turnaround needs to be implemented. Lenders without these protections put themselves in a very difficult spot when things are not going well.

Active Portfolio Management:

The second principle – practicing active portfolio management – is refined through experience gained over economic cycles. At the first signs of credit stress, managers need to be in front of issues and engage with borrowers. They will use the information rights discussed above to quickly uncover softening financial performance and track negative trends. If performance begins to falter, direct lenders should engage with the borrower well before any default to set expectations and begin to understand if the borrower/lender are generally aligned.

Some of the key actions a lender can take at this stage:

- Encourage the private equity sponsor/owner to invest additional equity to pay down debt to a more manageable level and/or support liquidity. An owner’s receptivity to committing additional equity is a key data point on gauging their conviction that a business’ weakness is transitory and can be improved. Be prepared to offer more flexibility and a generous time frame for borrowers to work through issues in return for the additional equity capital.

- Ensure the business has appropriate liquidity to avoid disrupting the company’s operations and potentially degrading enterprise value. If needed, consider altering terms of cash pay interest to maintain appropriate levels of liquidity in conjunction with an equity investment from the owner. In many cases the lender’s focus should be on capital preservation and not maximizing P&L upside in these situations.

- Introduce a financial consultant when a business is struggling. Lenders can use the first available opportunity, usually a financial covenant default for which a waiver is required, to install a financial / turnaround advisor. Work with this advisor, who should have specific knowledge of the borrower’s industry, to get smarter on the operations and trajectory of the business in the event more aggressive action is necessary.

It is important to be patient with a struggling business if the sponsor is being supportive with both time and capital. However, managers need to be prepared to act quickly when a business continues to underperform, even after additional equity support and operational adjustments. A lender’s actions at that point should be completely focused on capital recovery.

- Stay out of bankruptcy: Keeping the company out of a contested bankruptcy and coming to a consensual path forward is very important in the middle market. These businesses and their inherent leveraged capital structures are simply not built for a contentious court managed restructuring process. The exception here is where all parties are looking to the court to effectuate the shedding of certain obligations and all parties head into the process with the same goals and definition of success.

- Lead the restructuring process: In certain situations (e.g., deal-weary equity account that is far out of the money) a lender led reorganization or sale process is often the best path forward. We have found allowing owners to retain their equity and continue to participate at the BOD level while addressing debt terms to introduce more operating flexibility makes a lender led restructuring (most often effectuated by a BOD controlled by independent directors) quite palatable to the owners.

- Flexibility and capital support: During the restructuring process, especially as a lender leading the restructuring process, remain flexible and be prepared to inject capital to support recovery. This is not a call to throw “good money after bad,” but the realization that flexibility in terms of time frame for recovery and additional capital to effectuate the recovery is important.

So, what’s the “punchline”?

Private credit is playing an increasingly important role in investment portfolios. Heading into what could be the asset class’ first experience with an economic downturn and tighter credit conditions, investors are right to question how it will perform when tested. No one has a crystal ball, but one factor is important to call out: Manager selection is paramount.

Avoiding the asset class over the next cycle due to uncertain economic headwinds or the “denominator effect” might not be the best decision given the stable returns and consistent income private credit has delivered. Instead, investors should identify private credit managers with the skill set and track record to preserve capital and ensure returns amid challenging market conditions.

What Will Differentiate Private Credit Managers in the Next Downturn

)